tax abatement definition accounting

Penalties may represent 25 of what you owe to the IRS. 14 Who are covered under rent-a-cab service.

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

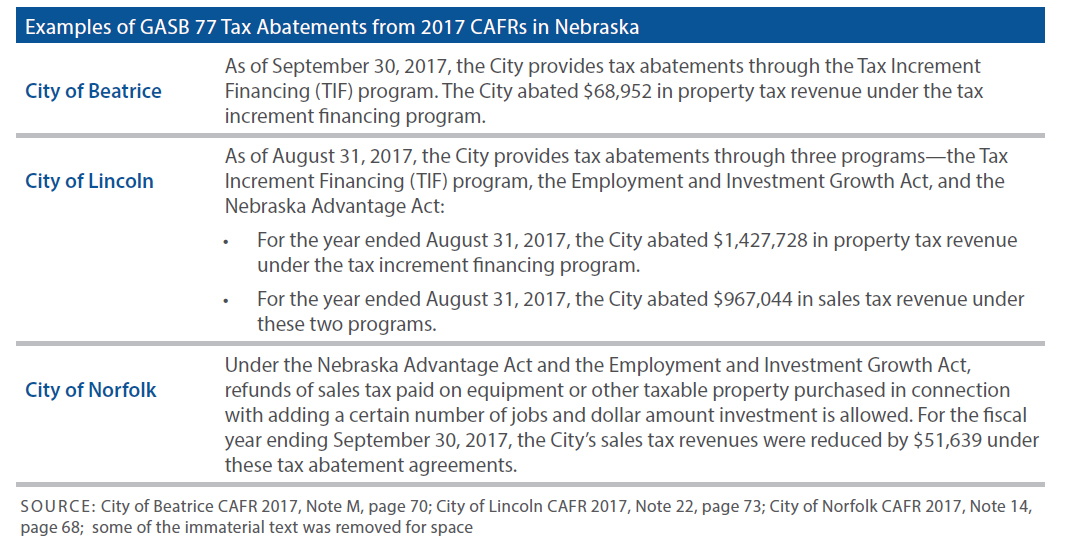

An abatement is also a refund for overpaying.

. The most common ad valorem taxes are property taxes levied on real estate. Enter the day after the end date on the previous franchise tax report. Getting these removed can make a real difference.

Learn everything an expat should know about managing finances in Germany including bank accounts paying taxes getting insurance and investing. Note X Tax Abatement. Meaning of Work-Contract-Clause 44 of section 65B of Finance Act 1994 defines the Work-Contact as follows.

Find dynamic cloud-based tax and accounting software solutions to standardize automate and streamline processes along with next-gen research tools that help businesses apply practical solutions to real-world. Funds are taken from earned income and contributed to the 401k benefit over an extended period of time. For entities that became subject to the tax after October 3 2009 enter the date the entity became subject to the tax.

The term tax shelter for this purpose means a partnership or other entity any investment plan or arrangement or any other plan or arrangement if a significant purpose of such partnership entity plan or arrangement is the avoidance or evasion of federal income tax. Retirement benefits are provided to the employee by the employer. 57 Common Accounting Terms.

Accounting Year End Date. Enter the day after the end date on the previous franchise tax report. If your tax assessment is too high you may be able to negotiate a better deal.

Works contract means a contract wherein transfer of property in goods involved in the execution of such contract is leviable to tax as sale of goods and such contract is for the purpose of carrying out construction erection commissioning. The Right Solutions for Your Tax Accounting Needs. Added link to the WA State Department of Revenue page containing information regarding states abatements.

Income from Mutual funds. A lessening of tax for companies results in an incentive to grow. So the definition given at answer to Q1 is not the statutory definition but adopted for the sake of convenience to name such specific description.

File Form 843 to request an abatement of taxes interest penalties fees and additions to tax. Accounting Year Begin Date. Select from a full range of solutions designed to drive productivity navigate change and improve efficiency.

Huf member name. Property tax is a tax assessed on real estate. Negotiate Your Tax Bill.

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older. INCOME FROM HOUSE PROPERTY. Also added new ID.

63 Under the regulations however tax shelter is defined arguably more leniently as a partnership entity plan or. Also for payment of tax the accounting code 00440048 of rent a cab operator service is the most appropriate code for such service. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

Clarified that the governments should be reporting both short- and long-term liabilities on the Schedule. The tax is usually based on the value of the property including the land you own and is often assessed by local or municipal governments. The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 54000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns.

This update was communicated on March 7 2018 in the BARS Alert.

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

Due Dates Advance Tax Payments Due Date Tax Payment Tax Deducted At Source

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download

A Solar Powered Home Will It Pay Off Property Tax Mortgage Lenders Top Mortgage Lenders

Due Dates Tds Tax Deducted At Source Due Date Dating

Part Ten Other Types Of Tax Accounting City Maintenance And Construction Tax Definition City Maintenance And Construction Tax Is The Country To Engage Ppt Download